March 22, 2025

How to Maintain a Healthy Credit or CIBIL Score in India

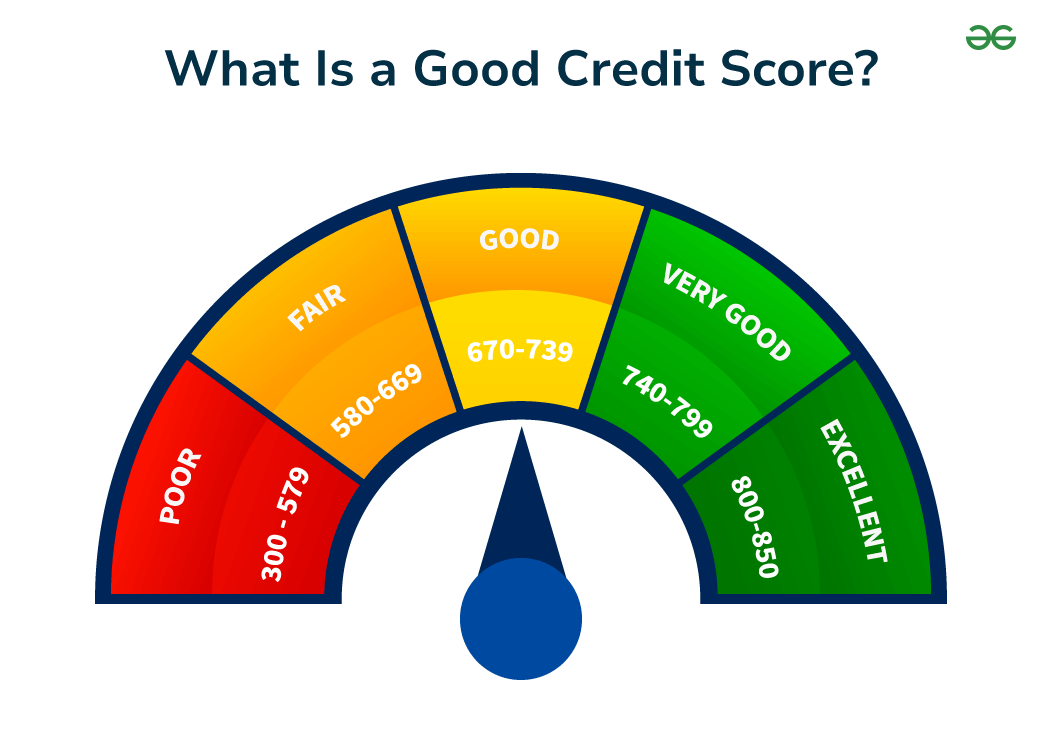

In today’s digital financial ecosystem, having a healthy CIBIL score is no longer optional—it’s a must for anyone looking to apply for a loan, credit card, or even a home loan. Your credit score is a direct reflection of your financial discipline. It tells lenders how trustworthy you are when it comes to repaying borrowed money.

At office247india, we not only help you file your IT returns, GST returns, and complete Udyog Aadhar registration, but we also care about your financial health—including your CIBIL score management.

So, how do you ensure your score stays high and healthy?

✅ 1. Pay Your EMIs and Credit Card Bills on Time

Late payments are the fastest way to damage your CIBIL score. Always pay your EMIs and credit card dues before the due date. Even a single missed payment can reduce your score by 50–100 points!

Pro tip from office247india: Set up auto-debit instructions or payment reminders so you never miss a deadline.

💳 2. Maintain a Low Credit Utilization Ratio

If your credit limit is ₹1,00,000 and you use ₹90,000 every month, that’s a 90% utilization ratio—way too high! Experts recommend using less than 30% of your credit limit regularly.

Keeping your credit usage low signals that you’re financially stable and not credit-hungry.

🧾 3. Monitor Your Credit Report Regularly

Sometimes, your CIBIL report might show incorrect or outdated information. It’s important to check your credit report at least once every 3 months to ensure everything is accurate.

You can get a free credit report from CIBIL or other bureaus once a year. If you spot any errors, raise a dispute immediately.

🏛 4. Don’t Apply for Too Much Credit at Once

Multiple loan or credit card applications within a short span of time make you look desperate for credit. Every time you apply, a hard inquiry is made, which can lower your score temporarily.

Apply for credit only when necessary and space out your applications.

🧠 5. Build a Long Credit History

A long credit history works in your favor. It shows lenders that you have long-term experience managing credit responsibly. Avoid closing old credit cards unless absolutely necessary.

Office247india can help you manage your financial documents, income tax returns, and business registrations, ensuring a consistent financial track record for the long run.

🛡 6. Keep a Healthy Mix of Credit Types

Having a mix of secured (like home loans) and unsecured (like credit cards or personal loans) credit types in your report shows that you can handle different types of debt responsibly.

#CreditScoreIndia #CIBILScoreTips #ImproveCreditScore #CreditHealth #LoanApprovalTips #FinancialTipsIndia #Office247India #CreditCardTips #MaintainCIBIL #CreditAwareness #FinanceWithOffice247 #GSTReturnFiling #ITReturnIndia

At office247india, we not only help you file your IT returns, GST returns, and complete Udyog Aadhar registration, but we also care about your financial health—including your CIBIL score management.

So, how do you ensure your score stays high and healthy?

✅ 1. Pay Your EMIs and Credit Card Bills on Time

Late payments are the fastest way to damage your CIBIL score. Always pay your EMIs and credit card dues before the due date. Even a single missed payment can reduce your score by 50–100 points!

Pro tip from office247india: Set up auto-debit instructions or payment reminders so you never miss a deadline.

💳 2. Maintain a Low Credit Utilization Ratio

If your credit limit is ₹1,00,000 and you use ₹90,000 every month, that’s a 90% utilization ratio—way too high! Experts recommend using less than 30% of your credit limit regularly.

Keeping your credit usage low signals that you’re financially stable and not credit-hungry.

🧾 3. Monitor Your Credit Report Regularly

Sometimes, your CIBIL report might show incorrect or outdated information. It’s important to check your credit report at least once every 3 months to ensure everything is accurate.

You can get a free credit report from CIBIL or other bureaus once a year. If you spot any errors, raise a dispute immediately.

🏛 4. Don’t Apply for Too Much Credit at Once

Multiple loan or credit card applications within a short span of time make you look desperate for credit. Every time you apply, a hard inquiry is made, which can lower your score temporarily.

Apply for credit only when necessary and space out your applications.

🧠 5. Build a Long Credit History

A long credit history works in your favor. It shows lenders that you have long-term experience managing credit responsibly. Avoid closing old credit cards unless absolutely necessary.

Office247india can help you manage your financial documents, income tax returns, and business registrations, ensuring a consistent financial track record for the long run.

🛡 6. Keep a Healthy Mix of Credit Types

Having a mix of secured (like home loans) and unsecured (like credit cards or personal loans) credit types in your report shows that you can handle different types of debt responsibly.

#CreditScoreIndia #CIBILScoreTips #ImproveCreditScore #CreditHealth #LoanApprovalTips #FinancialTipsIndia #Office247India #CreditCardTips #MaintainCIBIL #CreditAwareness #FinanceWithOffice247 #GSTReturnFiling #ITReturnIndia